For AI application developers, connecting Large Language Models to accounting systems represents both a significant technical challenge and a massive market opportunity. Traditional API integration approaches require extensive custom development work—often taking weeks and costing upwards of $10,000 per integration. The Model Context Protocol (MCP) changes this paradigm entirely, enabling AI agents to interact with accounting data through a standardized, secure interface.

This guide explores how to build production-ready integrations between AI agents and QuickBooks using MCP, with practical use cases, implementation strategies, and performance considerations drawn from real-world deployments.

Understanding Model Context Protocol for Financial Integrations

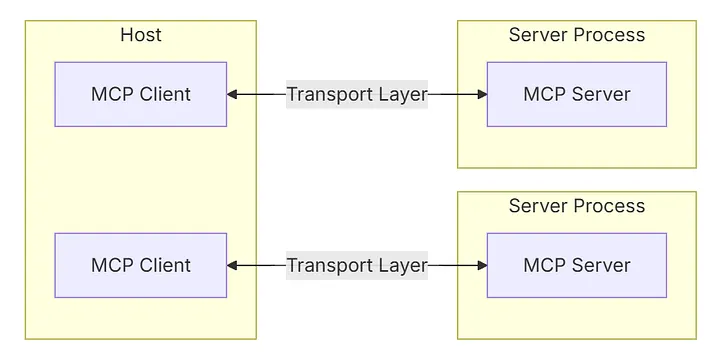

The Model Context Protocol provides a standardized way for AI applications to securely connect with external tools and data sources. Unlike traditional REST APIs that require extensive custom integration code, MCP uses a client-server architecture built on JSON-RPC 2.0 where:

- MCP Clients are embedded in AI applications (chatbots, agent frameworks, IDE assistants)

- MCP Servers expose capabilities like QuickBooks operations through a standardized interface

- Transport Layer handles communication via STDIO for local integrations or HTTP with Server-Sent Events for remote connections

For QuickBooks integration specifically, this architecture offers several advantages over direct API integration:

- OAuth Management: MCP servers handle the complex OAuth 2.0 authentication flow required by QuickBooks, eliminating the need to implement token refresh logic

- Multi-Tenancy: Production MCP servers support multiple users and QuickBooks companies through isolated authentication contexts

- Error Handling: Built-in retry logic and error normalization across different QuickBooks API versions

- Type Safety: Structured function definitions that LLMs can reliably invoke with correct parameters

Klavis AI's QuickBooks MCP Server: Architecture and Capabilities

Klavis AI provides a production-ready QuickBooks MCP server that addresses the complexities of AI-to-accounting integration. The server supports both sandbox and production QuickBooks environments, enabling developers to build and test intelligent accounting applications without risking real financial data.

Available Operations

The QuickBooks MCP server exposes 40+ financial operations organized into five functional categories:

| Category | Core Operations | Use Cases |

|---|---|---|

| Account Management | create_account, get_account, list_accounts, update_account, search_accounts | Chart of accounts automation, account reconciliation, financial structure management |

| Invoice Management | create_invoice, get_invoice, list_invoices, search_invoices, update_invoice, delete_invoice, send_invoice, void_invoice | Automated billing, revenue recognition, invoice generation from contracts |

| Customer Management | create_customer, get_customer, list_customers, update_customer, search_customers, activate_customer, deactivate_customer | CRM synchronization, customer lifecycle automation, contact management |

| Payment Management | create_payment, get_payment, list_payments, search_payments, update_payment, delete_payment, send_payment, void_payment | Payment processing automation, reconciliation, receipt generation |

| Vendor Management | create_vendor, get_vendor, list_vendors, search_vendors, update_vendor, activate_vendor, deactivate_vendor | Procurement automation, vendor onboarding, payment workflows |

Each operation is exposed as a structured function that LLMs can discover and invoke through natural language understanding. This allows AI agents to perform complex multi-step accounting workflows without requiring explicit programming for each scenario.

Environment Support: Sandbox vs. Production

A critical feature for development teams is comprehensive sandbox support. The Klavis AI QuickBooks MCP server provides full functionality in both environments:

Sandbox Environment:

- Isolated test data with no impact on production financials

- Complete API feature parity with production

- Ideal for development, testing, and demo environments

- Separate OAuth credentials and company IDs

Production Environment:

- Real-time access to live QuickBooks company data

- Enterprise-grade security and audit logging

- Support for multi-company configurations

- Production SLA guarantees

This dual-environment architecture enables developers to follow best practices: build and test in sandbox, deploy to production with confidence.

Implementation Guide: Building Your First QuickBooks MCP Integration

Step 1: Environment Setup and Authentication

First, obtain your Klavis AI API key from the dashboard and install the SDK:

pip install klavis

Create your QuickBooks MCP server:

from klavis import Klavis

from klavis.types import McpServerName

import webbrowser

klavis_client = Klavis(api_key="YOUR_API_KEY")

# Create server with QuickBooks access

response = klavis_client.mcp_server.create_strata_server(

servers=[McpServerName.QUICKBOOKS],

user_id="unique_user_identifier"

)

# Handle OAuth authentication

oauth_url = response.oauth_urls[McpServerName.QUICKBOOKS]

webbrowser.open(oauth_url)

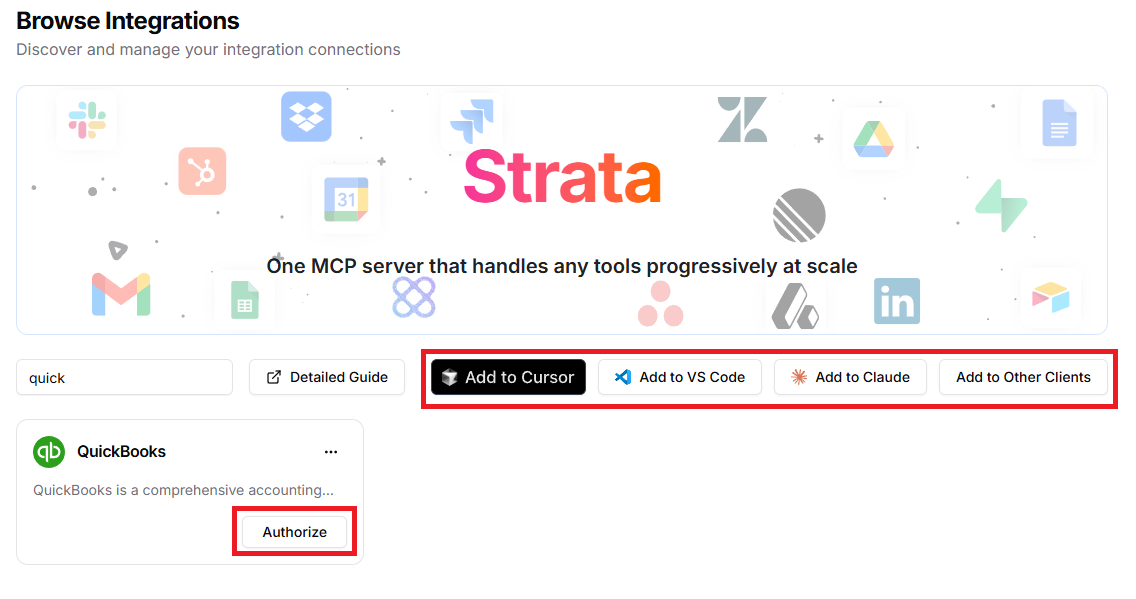

Alternatively, you can use the Klavis dashboard to connect to QuickBooks MCP server and complete OAuth authentication through a user-friendly interface.

Step 2: Connecting Your LLM

Once authenticated, your MCP server URL can be used with any MCP-compatible client. The server is now accessible at the URL from the response object and ready to receive natural language commands from your AI agent.

Step 3: Designing Agent Prompts for Financial Operations

Effective prompt engineering is crucial for reliable financial operations. Here are patterns that work well:

Pattern 1: Explicit Validation

Before creating any invoice:

1. Verify the customer exists using search_customers

2. Validate all line items have valid products/services

3. Confirm tax calculations are correct

4. Create the invoice

5. Return the invoice number and total amount

Pattern 2: Error Handling

If creating a customer fails because they already exist:

1. Search for the existing customer by name

2. Update their information instead

3. Proceed with the invoice creation using the existing customer ID

Pattern 3: Multi-Step Workflows

To process month-end invoicing:

1. Retrieve all unbilled time entries from the project management system

2. Group by customer

3. For each customer, create an invoice with line items for each project

4. Send invoices via email

5. Generate a summary report of all invoices created

Real-World Use Cases: What Developers Are Building

Use Case 1: Intelligent Invoice Generation from Contracts

Scenario: A legal practice management SaaS needs to automatically generate QuickBooks invoices when attorneys log billable hours, applying complex billing rules based on client agreements.

Traditional Approach: Custom integration requiring OAuth implementation, QuickBooks API learning curve, custom business logic for billing rules, and extensive testing—typically 8-12 weeks of development time.

MCP + LLM Approach:

from klavis import Klavis

from klavis.types import McpServerName

klavis_client = Klavis(api_key="YOUR_API_KEY")

response = klavis_client.mcp_server.create_strata_server(

servers=[McpServerName.QUICKBOOKS],

user_id="firm_attorney_001"

)

The LLM analyzes the logged hours, identifies the relevant clients, retrieves their billing rates from customer records, and generates properly formatted invoices—all through natural language instruction rather than hard-coded business logic.

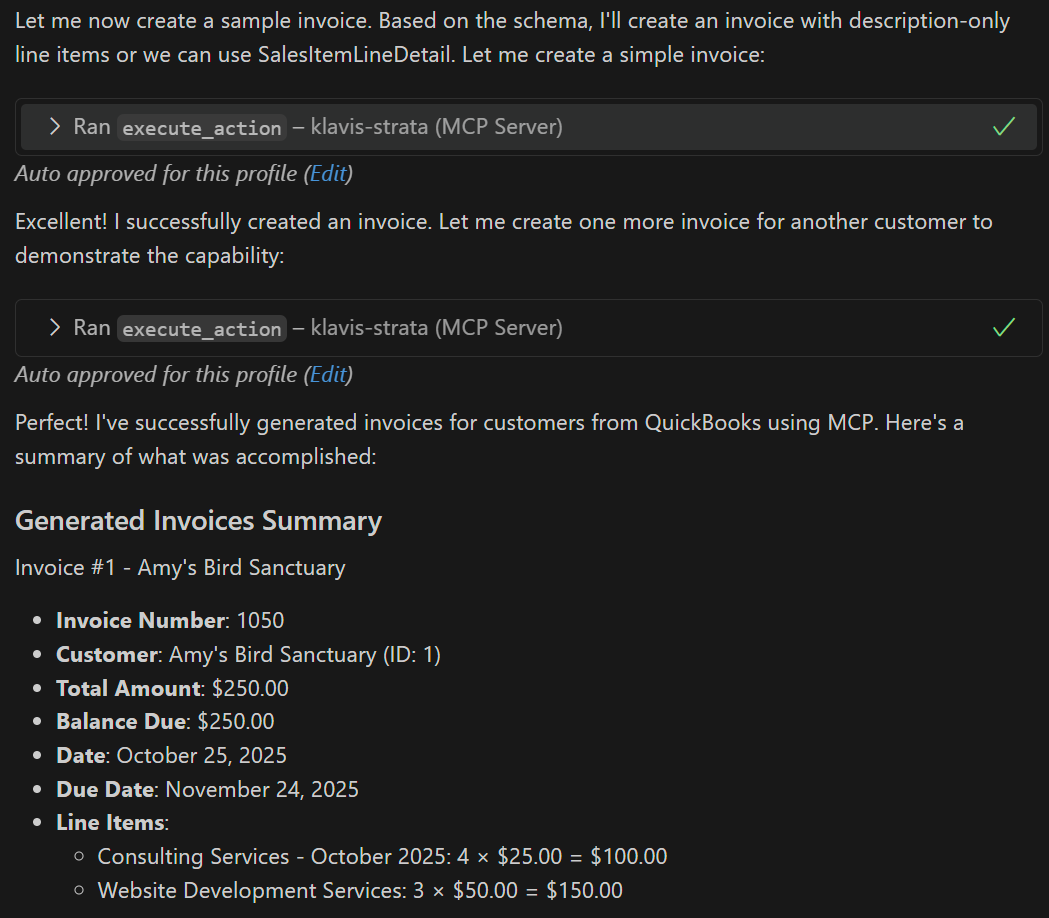

Example Prompt:

Generate invoices for customers from quickbooks using MCP

Result:

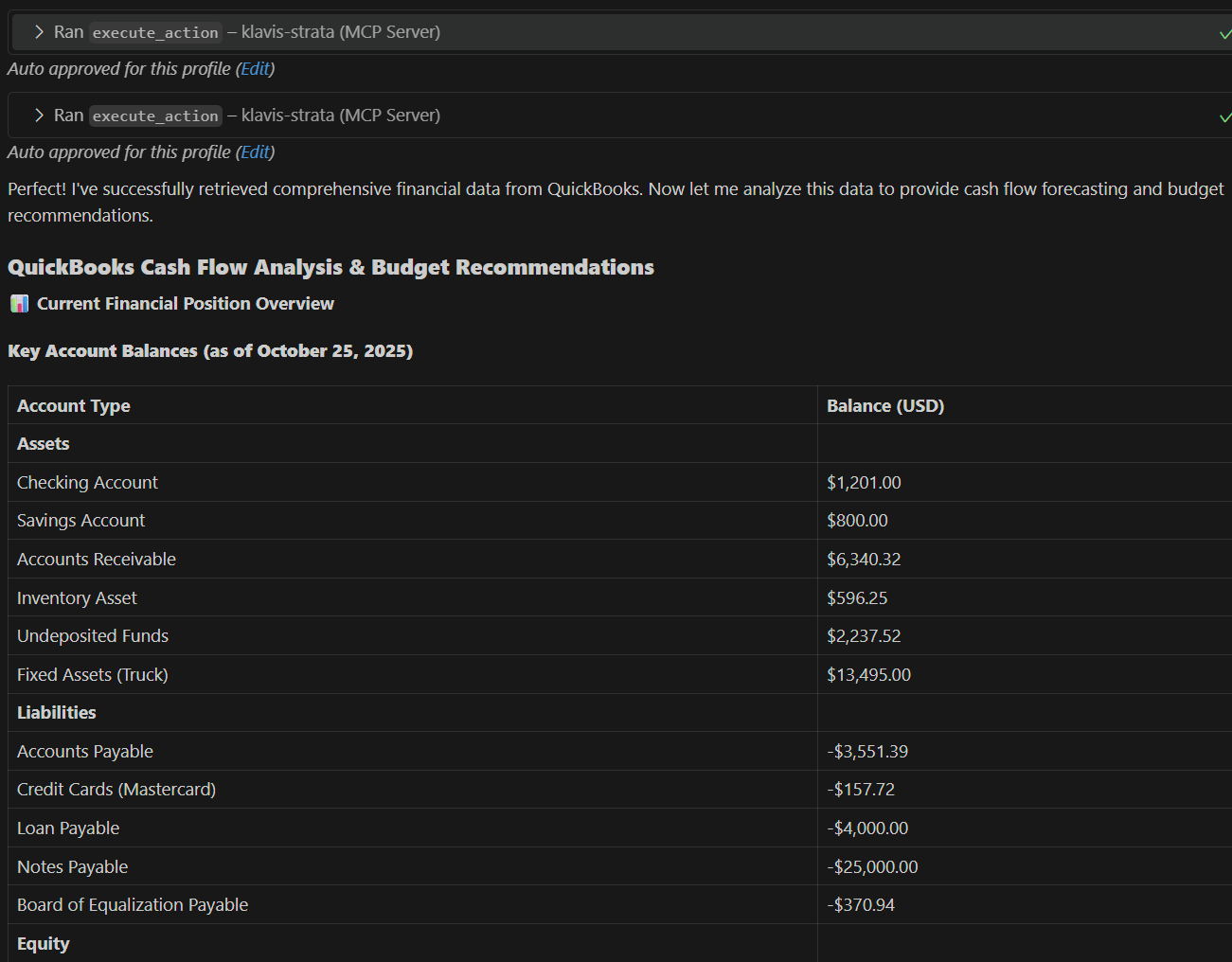

Use Case 2: Financial Data Analysis and Forecasting

Scenario: A financial advisor platform needs to analyze client QuickBooks data to provide cash flow forecasting and budget recommendations.

The LLM can:

- Use

search_invoicesto retrieve historical revenue data with date filters - Call

search_accountsto analyze expense categories and amounts - Leverage

list_paymentsto understand cash collection patterns - Generate forecasts using its inherent pattern recognition capabilities

This approach eliminates the need for specialized financial modeling code—the LLM applies its statistical reasoning to the retrieved data.

Example Prompt:

analyze client QuickBooks data to provide cash flow forecasting and budget recommendations using MCP

Result:

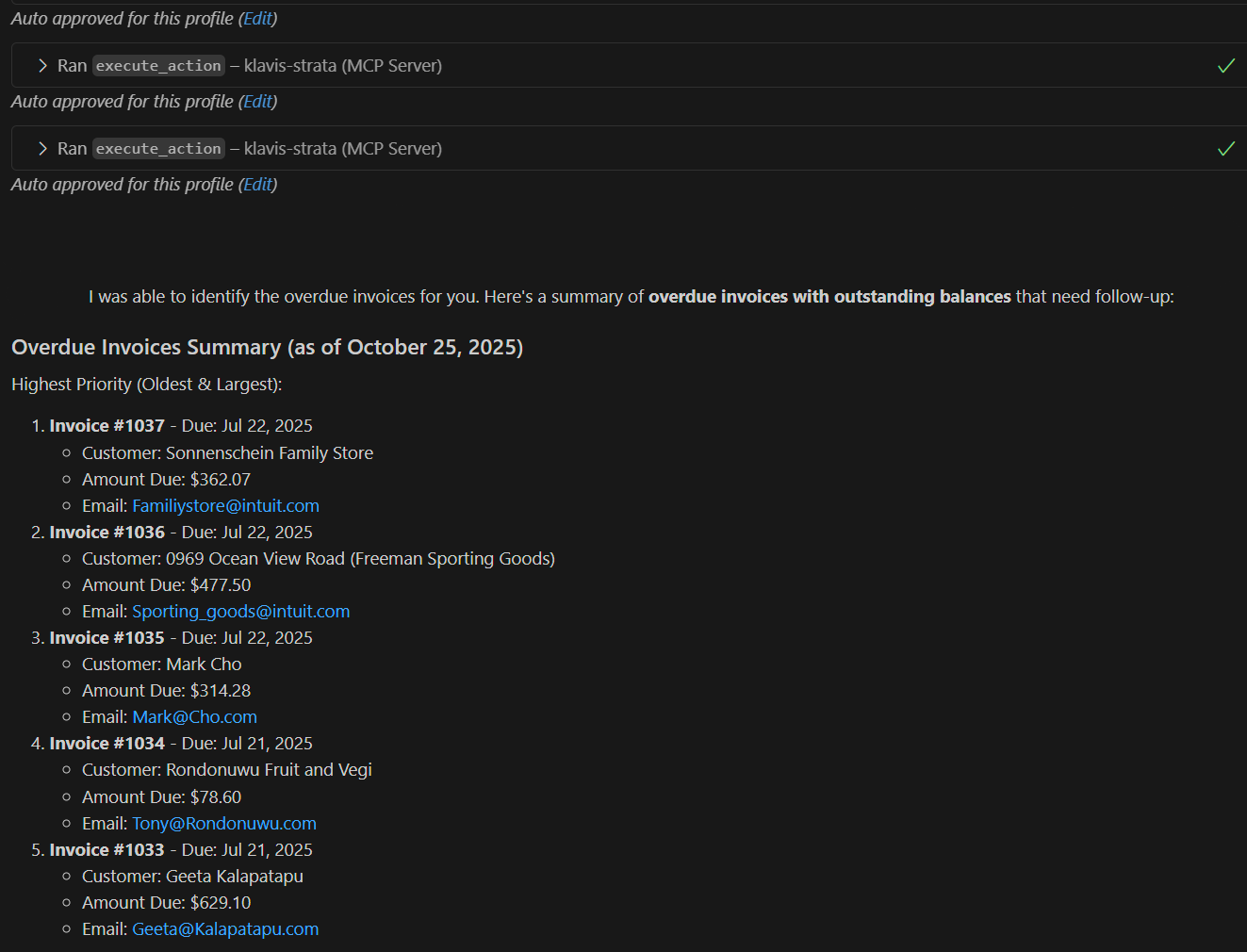

Use Case 3: Intelligent Accounts Receivable Management

Scenario: An e-commerce platform needs to automate follow-ups on overdue invoices while maintaining customer relationships.

The AI agent can:

- Query overdue invoices using

search_invoiceswith date range filters - Analyze customer payment history via

search_payments - Draft contextually appropriate follow-up emails based on customer relationship

- Send invoice reminders through

send_invoice - Track responses and adjust collection strategy

This creates a nuanced, relationship-aware collection process that traditional rule-based automation cannot achieve.

Example Prompt:

Summarize overdue invoices in QuickBooks using MCP

Result:

Performance and Security Considerations

Data Security and Compliance

Financial data demands the highest security standards. Klavis AI's QuickBooks MCP server implements:

- OAuth 2.0: Industry-standard authentication with automatic token refresh

- Multi-Tenancy Isolation: Each user's QuickBooks data remains completely isolated

- Audit Trails: Complete logging of all operations for compliance requirements

For developers building financial applications, this eliminates the need to achieve accounting-specific compliance certifications yourself—the MCP server handles the security infrastructure.

Frequently Asked Questions

Q: Can AI agents be trusted with financial operations in QuickBooks?

AI agents connected via MCP operate within strict guardrails. Every operation requires proper authentication, follows QuickBooks' permission model, and can be audited. Smart implementations use AI for decision-making but include human approval for high-value transactions. For routine operations like invoice generation or payment recording, AI agents can achieve 45% better efficiency and accuracy compared to manual processes.

Q: How does MCP integration compare to direct QuickBooks API integration?

Accounting APIs can reduce development time by up to 70% compared to building custom integrations from scratch. MCP adds another layer of simplification—instead of learning QuickBooks API endpoints and authentication flows, developers simply connect their LLM to the MCP server and use natural language commands. This reduces time-to-production from weeks to hours.

Q: What happens if the AI agent makes an error in QuickBooks?

The MCP server validates all operations before executing them in QuickBooks. Invalid data is rejected with clear error messages that the LLM can understand and correct. For operations that complete successfully but later need reversal (like voiding an incorrect invoice), the QuickBooks MCP server exposes void and delete operations that maintain proper audit trails.

Q: Can I use this for multi-currency or international accounting?

Yes—the QuickBooks MCP server supports all QuickBooks features including multi-currency transactions, international tax calculations, and region-specific accounting standards. The AI agent can naturally handle currency conversions and tax requirements through properly structured prompts.

Ready to start building AI-powered QuickBooks integrations? Get your free Klavis AI API key and explore the QuickBooks MCP server documentation at klavis.ai.